By Greg Fedorinchik, Managing Director, Equity Capital Markets

Comparing returns for taxable accounts on an “apples-to-apples” basis requires that investments be compared on an after-tax basis. Many real estate investments are inherently more tax efficient than other types of passive investments—and that is particularly so with respect to equity investments in real estate development projects or funds like those offered by NexMetro Communities. Below, the NexMetro Financial Planning and Analysis team estimates the effective tax rate for some of our recent project sales and discusses their tax efficiency relative to other types of growth investments.

What are the key characteristics that can help to improve tax efficiency and reduce an investment’s effective tax rate?

1.) Generating passive losses: Passive (non-cash) losses from operating expenses and depreciation in early years can be particularly beneficial from a tax perspective since those paper losses can offset other passive income in taxable portfolios and unused passive losses are carried forward to future years.

2.) Minimizing distributable net income: Income is generally taxed at the highest marginal tax rate (up to 37%) for high income earners. Therefore, investments that generate and distribute high levels of income are less tax efficient.

3.) Long-term capital gains vs short-term capital gains: Long-term capital gains (gains on investments held for more than one year) are typically subject to a lower, 20% federal tax rate, while short-term capital gains tend to be taxed like regular income.

What are the impacts of taxes and benefits of lowering the effective tax rate? Consider this example. If a $1M initial investment returned a simple 20% each year over a 5-year period it would effectively double to approximately $2M. That would be a 20% internal rate of return (IRR) a 2.0X multiple on invested capital (MOIC) and $1M in income and gains before taxes. If we assume the returns were comprised of equal amounts of income and realized gains, we might reasonably assume an all-in effective tax rate of 28% (blending capital gains and income), yielding an after-tax amount of $720,000. In this example, the after-tax IRR drops to 14.4% and the MOIC to 1.72X.

In this example, a reduction of the effective tax rate from 28% to15% would yield an after-tax amount of $850,000 for the investor – or $130,000 more in the investor’s pocket. The effective after-tax IRR would jump from up to 17% and the MOIC would rise from 1.72 to 1.85. Taxes matter. A lot. And, while this example uses a number of simplifying assumptions regarding the timing of cash flows, we believe it might actually be conservative in considering the benefits of investing in real estate development projects and funds vs. other types of investments.

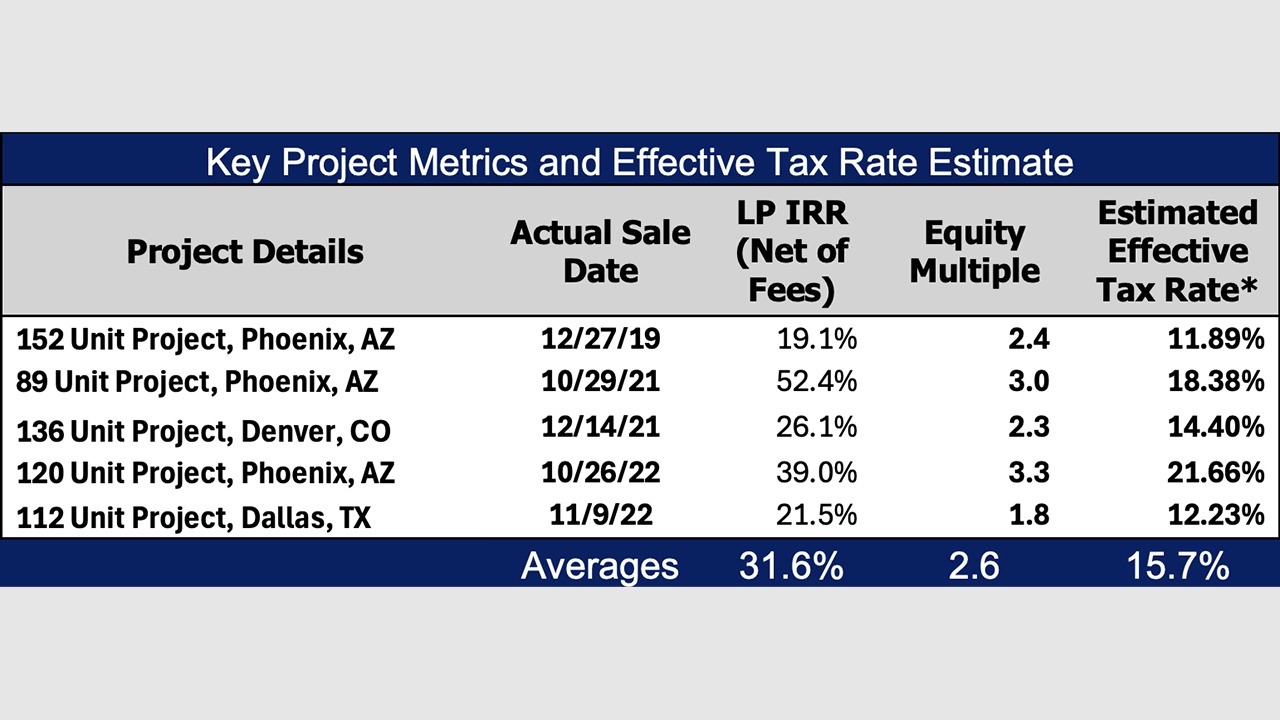

NexMetro has analyzed results across our five most recently completed and exited projects to assess what the effective tax rate has been. We estimate the average effective tax rate on these recent project sales to be about 15.7% and believe this compares favorably to other growth investments that could have effective tax rates in the 25-30% range or higher. The results are summarized in the table below.